by Lauren Etter: If you want to turn a secretive hedge fund manager and his deep-pocketed allies into activists, hook their kids on vaping.

An excerpt from the new book The Devil’s Playbook.

Atherton, Calif., once a quiet whistle-stop along the Southern Pacific Railroad, is situated 30 miles south of San Francisco and minutes from downtown Palo Alto. Fewer than 10,000 people live there, many of them behind tall hedges and forbidding gates. It’s the wealthiest city in America, with an average annual income above $525,000, and its residents have included some of the world’s most famous technology executives, including Eric Schmidt from Google and Sheryl Sandberg from Facebook. NBA star Stephen Curry bought a $31 million estate there. Microsoft co-founder Paul Allen had one worth $35 million.

In comparison, Kevin Burns’s stately home in an Atherton neighborhood called King Estates seemed modest. Toward the end of the summer in 2017, Burns was sitting in the kitchen with his son and some of his son’s friends. They were students at Palo Alto High School—Paly, as it’s known by locals.

About a year earlier, Burns had left Chobani, the yogurt company, where he’d pulled off an operational miracle. After being brought in from the private equity firm TPG Capital, he’d righted the ship of a promising company that had been almost ruined by a crisis that saw sour, bubbling, oozing cups of moldy yogurt wind up in grocery store coolers, sickening dozens and leading to a nationwide recall. The feat solidified his reputation as a turnaround guru. Now he was considering taking a new job, this time as the chief executive officer of Juul Labs.

Juul was the nation’s most popular e-cigarette. It was born from a provocative thesis project several years earlier by Stanford graduate students James Monsees and Adam Bowen. With more than 34 million smokers in the U.S. and 1 billion worldwide, they envisioned creating a less harmful version of the notorious burning stick. It would vaporize little tufts of tobacco, providing smokers with the nicotine fix they desired while reducing or eliminating the combustion that causes lung disease and contributes to more than 480,000 annual deaths in the U.S. In a closet-size room in a shared, rickety house just off campus, beside an old apple orchard, Monsees and Bowen shaped a product they hoped would—this was Silicon Valley, after all—change the world. Ultimately their project morphed into Juul, a device that dispensed a potent nicotine aerosol that could taste like dessert and fruit.

By the time Burns was up for the top job at Juul, the company had grown into one of Silicon Valley’s most illustrious startups. It had also become one of the most controversial, for its role in hooking millions of teenagers on nicotine. Burns wanted to do his own market research. The New Yorker described how he convened a meeting with his son and his friends and asked them about vaping. Three of them pulled Juuls from their pockets. Juuling had become a thing at Paly. The bathroom by the art classroom had become the most popular location, and the best place for teachers, if they came in at the right moment, to catch students exhaling vape clouds before they vanished into nothingness.

That fall the Palo Alto High student newspaper, the Campanile, conducted a survey in which more than half of the 269 students surveyed reported vaping. Of those, half used Juul. “Clearly, vaping has become a habit on campus,” the accompanying article read. “For many students, Juuling brings a very attractive social aspect. Students pass around the Juul and meet new people through this act, breaking the ice with a simple drag of the Juul.”

Burns’s son and his friends regaled Burns with stories of vaping, how they’d procured the devices, and how popular they’d become. For some people, the conversation might have served as a red flag. Not Burns. He’d been in private equity long enough to know that when you smell smoke, you run toward it, not away from it. That’s where the money is. (Burns did not respond to requests for comment for this story.)

“We could not be more pleased to announce Kevin as Juul Labs’ new CEO,” said Monsees in a news release on Dec. 11. “He was a key contributor to the extraordinary operational and strategic success at Chobani that positioned the company for long-term growth, strong financial fundamentals and continued innovation. We fully expect that he will bring similar success to Juul Labs.”

Burns arrived at Juul just as the company was moving boxes to its new, 30,000-square-foot headquarters on Pier 70 in the Dogpatch neighborhood of San Francisco, a stone’s throw from Bowen and Monsees’ first offices in an old tin-can factory. They kept their neighborhood haunts, but this time they had a better view of the San Francisco Bay. And instead of a handful of employees, Juul had more than 200, with the count growing by the day.

Burns was 54 when he took over. With closely cropped gray hair and a stocky build, he exuded an unyielding Rust Belt vibe. A metallurgical engineer by training, he’d gone straight from college to General Electric in the days when Jack Welch, the ruthless godfather of lean manufacturing, was still running the company. While there, Burns attended the company’s prestigious manufacturing management program; it set him on a path whipping ailing manufacturing companies into shape, Neutron Jack–style. He’d been doing it—for tire makers, and solar panel manufacturers, and chemical companies—for more than two decades.

At Juul it looked as if Burns had been dealt a series of fairly run-of-the-mill challenges. This company was a long way from yogurt, but Juul and Chobani shared a common problem: They’d both scaled too quickly and couldn’t keep up with all that the growth entailed. Burns had a plan and, because Juul had recently concluded a funding round, a war chest. But the enormity of what he walked into at Juul made sour milk and moldy yogurt seem like a dream.

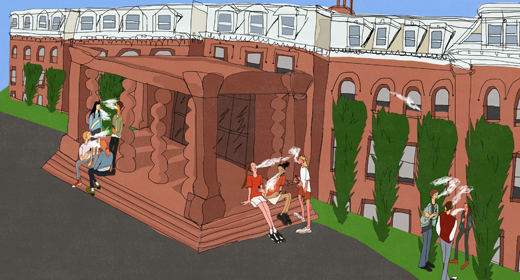

While Burns sent his kids to the public high school in Palo Alto, many of Atherton’s elite sent theirs to Sacred Heart Schools, a private institution on 64 serene acres in the middle of town. Founded as a boarding school in 1898 by an order of French nuns, it was now a day school for more than a thousand children, from preschool to 12th grade. For parents paying full tuition, the cost was up to $50,000 a year.

In early 2018, Emma Briger was a junior at Sacred Heart. She was a star goalie on the girls’ lacrosse team, the Gators, and had been named a captain of the varsity team. She was set on leading the Gators to the championship that year, so she was disappointed and somewhat shocked to learn that several of her teammates had taken up vaping. They’d hit the Juul before and after practice, and sometimes even vape marijuana, showing up to practice high. This irked her, but she didn’t know what to do. She didn’t want to seem like a killjoy or a tattletale. One night she turned to her dad, Pete, for advice. The two had developed a trusting and close relationship and bonded over sports. As they sat around the kitchen table in their Atherton home, Emma brought up the vaping.

“That’s impossible,” her dad replied.

“Dad, I’m really worried about this,” she said. “It’s affecting the whole team.”

Pete Briger wasn’t just another lacrosse dad. He was the billionaire co-CEO at Fortress Investment Group, a firm with more than $45 billion of assets under management. Briger had made a career at Goldman Sachs as a trader in distressed debt, raking in untold sums for the bank and becoming a pre-IPO partner before moving to Fortress and opening an office for the firm in San Francisco.

It wasn’t that Briger didn’t trust what his daughter was telling him. He was just in disbelief. He knew people did stupid things, but surely no kid who attended Sacred Heart would show up to lacrosse practice high. Over the next couple of weeks, however, Emma kept coming home with stories, and Briger and his wife, Devon, called the coach of the team, Wendy Kridel.

“Wendy, you know, my daughter is telling me that this is happening, and that it’s a real problem,” Briger told her.

“It’s not happening, Pete,” Kridel responded.

Like many others at the time, Kridel was in denial. She, like Briger, thought it inconceivable that these overachieving kids would be so reckless.

Briger and Kridel had a good relationship. “Just do me a favor,” Briger said. “Can you just go check into this?”

Within days, Kridel came back. “I’m just amazed,” she told him. “But you’re right.”

A few weeks later, in April, Kridel was preparing to take the Sacred Heart team to Denver over spring break to play some teams there. She called a meeting with the girls and their parents one day after practice to discuss details of the upcoming trip. After talking about the travel itinerary and other logistics, Kridel brought up vaping. She said that not only was Juuling unhealthy and addictive, but it was also against school rules, and she had a zero-tolerance policy. If any of the girls got caught vaping on the trip, they’d be immediately sent home at their parents’ expense. They’d also risk being kicked off the team.

“Don’t do this,” Kridel warned, in her booming coach voice. “This is really bad for you.”

The following week the team landed in Denver, just as a snowstorm was getting ready to barrel down. Briger was accompanying his daughter and would be staying with family while the team posted up at a hotel. The next day, Kridel was approached by three of her players. “There were girls vaping in their hotel room,” they said.

Kridel was beside herself. A dramatic confrontation with the girls ensued, and it turned out two players had been Juuling. Kridel sent them home the next morning, and they never played for the Sacred Heart Gators again.

Briger was dumbfounded when Kridel told him about the turn of events. The trip was for only three days. “Wendy, that’s crazy. How could they do that?” he asked.

When Briger returned home, he couldn’t stop thinking about what had transpired. Did the girls not have supportive parents? Were they simply that distracted? Or that reckless?

Then it dawned on him. These girls were so hooked on Juul that they were willing to risk everything they’d worked for to have more of it. This was addiction.

As summer got under way, David Burke settled in to write a scathing message from his home in Atherton. The object of his rage was his neighbor, Kevin Burns, who lived a five-minute drive away.

Burke was a former managing director of the Stanford Management Co., where he oversaw private equity and venture capital investments for the university’s endowment. He’d had a long career at Makena Capital Management, a $20 billion investment management firm he started with another Stanford alum, and he sat on numerous boards, including the Carnegie Endowment for International Peace, the University of Virginia, and Sacred Heart. His kids attended the school with Briger’s daughter.

Burke had started noticing something odd at his house. When his teenage children had friends over, he’d see these little devices plugged into the outlets by the basketball court as they were shooting hoops or by the pool as they were swimming. When he first saw them, he had no clue what they were—like so many others, he thought they were some sort of flash drive. He quickly learned otherwise.

Burke’s own father had started smoking cigarettes at 16 and struggled mightily with the habit until finally kicking it in his 40s. He’d died of esophageal cancer. Burke remembered watching with a sense of satisfaction and relief as smoking rates among kids ticked down year over year. Now he was furious. That’s how he ended up in front of his computer on the afternoon of June 23, banging out a note to Burns on LinkedIn:

Kevin,

I believe we’re both in the same Atherton community near Stanford. I just wanted to let you know that your stupid f—ing company has gotten my teenage kids’ friends hooked on nicotine. From here on out, I’m going to go out of my way to fight the bullshit that you all are doing there and will be more than vocal about it. I have deep ties in the investment world and am from Washington DC and have deep ties there, all of which I will leverage to the max. I hope you feel really great about making lots of money for yourselves, under the guise of helping old conventional smokers kick the habit, while you hook a whole new generation on something that a decade from now we’ll all know the truth about, just as things have played out with conventional smoking. Just like the Sackler family legacy with opiates, helping all those in pain while addicting millions and killing thousands. You’ll have a beautiful, proud legacy for you and your family to celebrate in future generations.

Best,

Dave Burke

After a few days passed, Burke could see that Burns had opened his LinkedIn message. But he received no reply. That made him even madder. He decided to take his anger public, with a post on Facebook:

Here is my vote for the most evil company in the world, making money hand over fist in large part by destroying the lives of what will prove to be millions of middle school students who get rapidly hooked on nicotine and cannot control their addiction. They know exactly what they are doing and where that revenue is coming from as they target their under age illegal audience with flavors like mango, bubblegum, and cool cucumber. Just like the now-exposed Sackler family which has destroyed the lives of millions from easy opiate access as their privately held company Purdue pocketed the cash and looked the other way. Don’t believe the bullshit PR statements they put out and their pledge of $30 million to “fight underage use,” which is a rounding error of their profits. I’ve seen the numbers and it’s appalling.

Not long after, Burke got a call from Briger, who’d seen the post. Briger was still fuming from the Denver lacrosse trip incident, and he’d since found a Juul in the bedroom of one of his sons. Briger shared the story with Burke, who in turn revealed his own tale about Juul infiltrating his kids’ peer groups. As the two men talked, they grew angrier.

“We’ve got to stop these people,” said Briger.

“Burns, this goddamned asshole, can you believe how despicable he is?” Burke replied. “I mean, they’re pumping massive amounts of nicotine into kids.”

“These people should go to jail,” Briger said.

The two men decided that their neighbor, Burns, and his company needed to pay. “The only way is to play hardball with them,” Briger said. “To make it uncomfortable for them. To let everybody know that people in our community are making money off this.”

Burke knew someone they could ask for help. The 2018 Stanford football season was just getting under way. It was Friday, one of the last before school started, and the first home game would be played that night at Stanford Stadium. Burke was a die-hard fan. He’d had season tickets, with the same seats in the upper deck, for years. And for as long as he could remember, the same person had had the seats right in front of him: Jim Steyer.

Many people knew Steyer because of his younger brother, Tom, the billionaire founder of the San Francisco hedge fund Farallon Capital Management and a former member of Stanford’s board of trustees (and later a candidate for the Democratic Party nomination for president). Jim was eminent in his own right, as a civil rights professor at Stanford and longtime advocate for children. A believer in the power of early education to beget a just and thriving society, Steyer had founded a group called Children Now, which helped shape policy in California and across the nation around issues such as access to immunizations and health insurance. Steyer had also long been concerned with youth exposure to sex, violence, and commercialism in media, and in 2003 he’d started another nonprofit, Common Sense Media. Originally a source for movie and media ratings for parents, it had become a grassroots army, with almost 150 million users.

Just before kickoff, Burke and Steyer were catching up—about their summers, their families, the kids’ plans for the year. Then Burke brought up vaping.

“Jim, have you heard about Juul?” Burke asked.

“Yeah, of course. I have four children. They’re like the new Big Tobacco.”

They began swapping stories. Burke told Steyer about Briger’s experience. Briger and Steyer knew each other.

“Well, you run the biggest child advocacy group in the country,” Burke said. “Do you want to get involved?”

Steyer decided to ask his own children what they knew about Juul. At the time he had a high schooler and three older children, one attending Stanford, the other two already graduated from Stanford. The high schooler not only confirmed that Juul was a big problem but acknowledged that he’d tried it himself. Steyer was incensed. “Do you understand how bad nicotine is?” he chided. His older kids chuckled at his naiveté. “You have no idea, Dad,” they said. “People Juul in your class at Stanford, and you don’t even know it.”

Steyer already had little love for the Silicon Valley companies that made a killing off addicting kids to video games and social media. Now here was one selling an actual addictive drug. It was a company born at Stanford, to boot. Steyer was in. Meanwhile in New York, a well-connected group of angry mothers whose own children had become all too familiar with Juul began organizing a group that was eventually called Parents Against Vaping E-cigarettes, or PAVe.

By the fall of 2018, a formidable group of wealthy parents whose children had fallen prey to nicotine addiction, from Atherton to San Francisco to New York City, were organizing in various ways to stop it.

Over the next year the fury of powerful parents like Briger, Burke, and Steyer was echoed by more American moms and dads who’d discovered Juul devices stashed in their kids’ backpacks or colorful plastic nicotine pods littering their bedrooms. The tide soon began to turn against Silicon Valley’s most dazzling startup. Briger and Burke donated money to a prominent Stanford researcher who evangelized about the dangers of tobacco use and vaping. Briger also became the first donor to PAVe, which went on to mobilize activists in almost every state to support antivaping laws and influence policy debates about e-cigarettes in city halls and statehouses, and, at least once, in the White House. Steyer and others joined a pitched battle in San Francisco against Juul that resulted in upholding a moratorium on e-cigarette sales in the city, kneecapping the company in its hometown. (Michael Bloomberg, majority owner of Bloomberg LP, which publishes Bloomberg Businessweek, was the largest donor to the campaign.)

The U.S. Food and Drug Administration began turning up the heat on the company as data showed that millions of middle school and high school students were vaping, a jarring public-health setback after two decades of declines in youth tobacco use. Lawmakers began investigating Juul’s marketing practices. State attorneys general began filing lawsuits against the company for its role in stoking the youth nicotine epidemic. A mysterious outbreak of acute lung injuries tied to vaping further spooked the nation. Class-action lawyers began filing a crush of product liability and racketeering lawsuits. A generation earlier, suits like these had brought Big Tobacco to its knees.

Juul’s largest outside investor, the tobacco company Altria, was coming under its own pressure as shareholders railed against its $12.8 billion investment in a corporation whose valuation was being written down quarter after quarter. That investment, in December 2018, had been the largest haul by a U.S. venture capital-backed company in Silicon Valley history, eclipsing deals done by Uber, WeWork, even SpaceX. Nicotine was frothier than rockets. Altria now values its 35% stake in Juul at $1.5 billion, which would imply a total valuation below $5 billion, from a peak of $38 billion. Juul’s 2020 revenue shrunk to under $1.5 billion, from a 2019 high of $2 billion.

The Federal Trade Commission has sued to unwind the deal between Juul and Altria, alleging that the two companies engaged in anticompetitive practices. An administrative trial is scheduled for June.

Meanwhile, Juul is waiting as the FDA considers whether to allow its product (and thousands of competing e-cigarette products) to continue to be sold in the U.S., a decision that could arrive this year. Juul has tried to salvage its future by bringing in new leadership, removing its candy-flavored products from the market, and relocating its headquarters to Washington, closer to those who will decide its fate.

The tobacco industry long ago learned that it was reliant on, and had to continually solicit, what it has referred to as “permission from society to exist.” Now, Juul is learning the same holds true for itself. The lesson is worthy of being taught at Stanford: The enemies you least want are the parents of your customers.

Adapted from The Devil’s Playbook: Big Tobacco, Juul, and the Addiction of a New Generation, publishing May 25. Copyright 2021 by Lauren Etter. Reprinted with the permission of Crown. All rights reserved.