by Fred Pearce: The demand for lithium for EV batteries is driving a mining boom in an arid Andes region of Argentina, Chile, and Bolivia, home to half the world’s reserves…

Hydrologists are warning the mines could drain vital ecosystems and deprive Indigenous communities of precious water.

What environmental price should the world be willing to pay for the metals needed to switch to electric vehicles? The question is being asked urgently in South America where there are growing fears that what is good for the global climate may be a disaster for some of the world’s rarest and most precious ecosystems — salt flats, wetlands, grazing pastures, and flamingo lakes high in the Andean mountains.

This remote region straddling the borders between Argentina, Bolivia, and Chile has become known as the Lithium Triangle, because it is the sudden focus of a global rush for the metal vital in making lithium-ion batteries to decarbonize the world’s automobiles. Demand for lithium is predicted to quadruple by 2030 to 2.4 million metric tons annually, and in anticipation, prices on world markets have risen close to tenfold in the past year.

According to the U.S. Geological Survey, more than half of the world’s lithium reserves are dissolved in ancient underground water within the Lithium Triangle. Global mining conglomerates are competing to grab the metal by pumping that water to the surface and evaporating it in the sun to concentrate the lithium carbonate that it contains.

Lithium is the lightest of all metals. Soft and malleable with a high capacity to store energy, it is ideal material to make lightweight, rechargeable batteries. Demand for the metal for lithium-ion batteries to power mobile devices has risen strongly for three decades. But while mobile-phone batteries require just a tenth of an ounce of lithium carbonate, a typical electric-car battery requires 130 pounds — around 20,000 times as much.

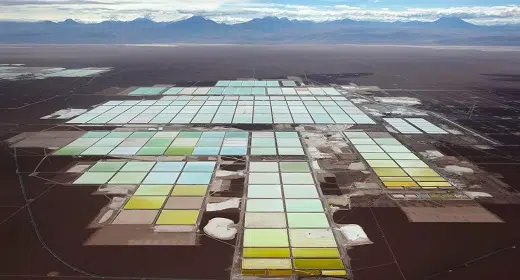

The Lithium Triangle region. YALE ENVIRONMENT 360

With the world’s car fleets transitioning to electric propulsion, Argentina, with reserves of up to 60 million metric tons, according to government estimates, is well-positioned to profit from the lithium rush. Lax regulation and low taxes make its part of the Lithium Triangle — in the northwestern provinces of Jujuy, Salta, and Catamarca — “especially attractive for foreign investors,” according to Lucas Gonzalez of the National Scientific and Technical Research Council (CONICET), a government agency in Buenos Aires. The country could soon become the world’s second-largest lithium producer, after Australia, and the largest producer from evaporative mining.

But every ton of lithium carbonate extracted from underground using this cheap, low-tech method typically dissipates into the air about half a million gallons of water that is vital to the arid high Andes. The extraction lowers water tables, and because freshwater often sits on top of salty water, this has the potential to dry up the lakes, wetlands, springs, and rivers that flourish where the underground water reaches the surface.

Hydrologists and conservationists say Argentina’s lithium rush is set to turn the region’s delicate ecosystems to desert. Meanwhile, the Indigenous people of the high Andes increasingly fear that the scarce water on which they rely for domestic use — and to keep alive the pastures on which their livestock depend — is being sacrificed in a global drive for green vehicles to fight climate change.

The Lithium Triangle comprises a series of enclosed basins more than 10,000 feet up in the Andes. Rainwater from the surrounding mountain peaks has for thousands of years flowed into the basins, forming lakes, wetlands, and salt pans, as well as accumulating underground. The water has brought with it large quantities of lithium carbonate and salts of sodium, boron, potassium, and magnesium that are eroded from the mountains.

The saltiness of the water in the basins varies from place to place. Recently arrived freshwater vital for wildlife and human communities is typically found around the edge of the basins, whereas saltier water is generally closer to the center, where decades of evaporation in the intense high-altitude sunlight has reduced the water and concentrated the lithium and other salts.

Some 50 mining projects are currently licensed or under active discussion in northwest Argentina alone.

Now, mining companies intend to extract lithium by dramatically accelerating this natural evaporation, by pumping salty underground water from wells into vast evaporation ponds they are creating across tens of square miles of the salt flats. In total, some 50 projects are currently licensed or under active discussion in northwest Argentina alone, covering an area larger than Delaware.

Typically, after a year or so in the sun, when the concentration of lithium carbonate in the water exceeds 3.5 percent, the brine will be sent by truck for further chemical treatment to extract the lithium. But by this time, about half a million gallons of water will have evaporated for every ton of lithium carbonate collected, calculates Victoria Flexer, a chemist at CONICET.

Several mining companies approached to comment on concerns about the impact of their activities did not respond. The U.S.-based Livent Corporation says, “Responsible stewardship of the environment is essential to our work. We utilize a comprehensive system to manage and record environmental parameters such as water flows, chemical transport, and salinity.” However, many independent hydrologists are skeptical that the extraction can be achieved without impacts on ecosystems and the water supplies of local communities.

The hydrology of the basins of the Lithium Triangle is poorly understood, according to Brendan Moran of the University of Massachusetts-Amherst, who has conducted detailed isotopic studies to determine the age and sources of the water. “The water often lies deep underground and flows across great distances and over long periods of time.”

Lithium-rich brine is pumped into evaporation pools at a mine in Potosi, Bolivia. CARLOS BECERRA / BLOOMBERG VIA GETTY IMAGES

The basins are usually hydrologically linked below ground, so lowering the water table in one place may lower it in others, according to Marcelo Sticco, a hydrogeologist at the University of Buenos Aires. “The extraction of water can affect wetlands and communities in an area many times bigger than the surface area” of the projects, says Roman Baigun, program manager for saving high Andean wetlands at the Wetlands International, a conservation organization. “Billions of liters of water are evaporated, never to return to the system.”

The forerunner for future lithium mining in Argentina is the Fenix project in the Salar del Hombre Muerto (Dead Man’s Salt Flat) covering 230 square miles of northern Catamarca, which has been operated by the Livent since 1997. With rising demand from auto manufacturers such as BMW and Tesla, the company recently completed a $640-million expansion that will double annual output to 40,000 tons. With reserves estimated at 1.2 million tons, it could keep that up for 30 years. But production requires pumping about 170,000 gallons of water from underground every hour to fill its giant emerald-green lagoons.

An even bigger project, Sales de Jujuy in the Olaroz basin in Jujuy, started extraction in 2014. It is a collaboration between Australian mining company Orocobre and Japanese carmaker Toyota Tsusho, which has first rights to its annual output of some 42,500 tons. In the same basin, another project, known as Minera Exar, is in preparation by Lithium Americas, a Canadian company, and Chinese giant Ganfeng Lithium. It plans to produce 40,000 tons annually for the next 40 years.

Environmental impacts may only accrue gradually, with what experts called the “slow, hidden and insidious depletion of water.”

Dozens more projects are being developed by local speculators, and as lithium prices have soared, global mining companies have been moving in to buy them up. Earlier this year, the 1.6-million-ton Tres Quebradas project was bought by Chinese mining giant Zijin, and part of the 1.4-million-ton Rincon salt pan reserve was purchased by the world’s second largest mining company, Rio Tinto.

Studies by local researchers have underlined the unique biodiversity that is threatened by developments that would drain the area’s wetlands, which are home to pumas, Andean foxes, vicuna, hairy armadillos, and endangered Andean mountain cats and short-tailed chinchillas. The wetlands’ bird life is also spectacular, says Patricia Marconi, an ornithologist and president of the Yuchan Foundation, an Argentinian conservation group. Some 70 percent of the world’s Andean and Puna flamingos live here, moving between the wetlands to feed on microscopic algae known as Bacillariophyta that are found in abundance.

Aside from such iconic species, the high Andes’ wetlands are among the most unusual ecosystems on Earth, Marconi says. They are rich in some of the earliest life forms on the planet, such as stromatolites, microbial mats, and mud-like organic deposits known as microbialites that “potentially could provide information about the early evolution of life.”

There are rich Indigenous cultures based around high Andean pastures that sustain herds of llamas and alpacas. The communities also harvest salt, cut peat for fuel, farm, and show sunscreened tourists around their blindingly white salty landscapes.

Andean flamingos on a lagoon in the Atacama Desert in northern Chile. WOLFGANG KAEHLER / LIGHTROCKET VIA GETTY IMAGES

These communities have been divided over whether to embrace the lithium rush. Some have been eager to take the handful of jobs on offer at the mines, and they welcome company inducements, such as schools and internet access not previously provided by the government. This has resulted in the Olaroz basin becoming a fast-growing hub for lithium extraction.

But others have grown more fearful. East of Olaroz, the 33 Atacama and Kolla indigenous communities around Salinas Grandes, the largest salt flat in Argentina, banded together a decade ago to set terms for allowing mining. But when those terms were rejected, they decided on outright opposition. “This is our territory. We decided that lithium will not be mined here, and they are going to have to respect us,” Veronica Chavez from the village of Santuario Tres Pozos told journalists.

After the Canadian company A.I.S. Resources began exploratory drilling in 2018, the communities held protests and blocked the main highway across their land to Chile. The company left and has yet to return.

Hydrologists warn that the threats from mining are not always obvious. Environmental impacts may only accrue gradually, with what Gonzalez and Richard Snyder of Brown University recently called the “slow, hidden and insidious depletion of water.” Still, as environmental impacts grow, they say, “buyer’s remorse” is increasing in Olaroz and elsewhere.

The Argentinian government and provincial authorities have taken a hands-off approach to mining, critics say.

On the Hombre Muerto salt flat, locals say pumping for the 25-year-old Fenix operation has lowered the water table so much that the Trapiche River, a major source of water for their meadows, has dried up, leaving their livestock nowhere to graze. The communities there have now mobilized to prevent the same thing happening to their other main source of water, the Patos River, which they believe is threatened by new wells.

The Argentinian government and provincial authorities have taken a hands-off approach to mining. They provide “little oversight,” say Gonzalez and Snyder, giving the companies freedom to organize both their own environmental assessments and community liaisons.

Marconi says that this has not resulted in good corporate practice. When she analyzed 11 company environmental impact assessments for lithium extraction, she says, she found that none included full hydrological analysis or rigorous assessment of the impact of evaporation ponds on local water supplies and wetlands.

Companies also skimp on local consultation, according to critics. In theory, they are required to obtain the “free, prior, and informed consent” of local communities for mining. But Pia Marchegiani, director of environmental policy at the Argentinian NGO Environmental and Natural Resources Foundation (FARN), found that in practice, local communities were either bypassed or bamboozled with reports in technical language they could not understand, while being denied information on the potential risks and environmental impacts of the projects. “The only information available is that provided by companies,” Marchegiani concluded. “Projects are gaining approval with little critical review.”

The Indigenous Kolla village of Susques, Argentina, near the Salinas Grandes lithium plant. RICARDO CEPPI / GETTY IMAGES

Critics of the current approach say that the likely environmental impacts are not an inevitable price for the rapid delivery of the raw materials needed for electric vehicles.

For one thing, there are alternatives to lithium. Zinc and nickel are both potential substitutes for lithium in rechargeable batteries. There are also ways of obtaining lithium that are less destructive than evaporating the metal from precious saline ecosystems.

A rival source is a lithium ore known as spodumene, found in igneous rocks known as pegmatite. The world’s largest hard-rock lithium mines are in Western Australia. Another major source is under development in the Democratic Republic of Congo. But hard-rock supplies are currently more expensive than those from evaporating brine, and mining them has a higher energy demand.

Flexer says lithium can be extracted from brine using other techniques that do not exhaust water supplies, including reverse osmosis and membranes that filter out the lithium. But currently, evaporating the precious water supplies of the high Andes is regarded as the quickest and cheapest method for a world in a hurry for lithium.

Priorities could change, however, if battery manufacturers, automakers, and their financiers started demanding metal from sources that are less environmentally destructive, says Jonathan Stacey of Birdlife International. “Now is the time to plan for certified lithium.”

“A truly sustainable energy sector,” says Marconi, “would consider the full life cycle of the battery [from] cradle to grave.”